Ways To Give

Contributing to the Kosciuszko

Foundation's Growth

As a public foundation, the KF fully depends on the generosity of its members and friends. For the last 90 years, in both good times and bad, the Kosciuszko Foundation has been serving the Polish-American community thanks to the kindness of its benefactors. In order to carry our mission on into the future we need your continued unwavering support. If our work is important to you, please lend us a hand, so we can grow together.

Passion for a charitable cause prompts us to share our resources with generosity. Nevertheless, it is nice to realize that our dedication to the KF's mission can be rewarded with financial benefits. This website is dedicated to educating you on your giving options and the potential financial benefits of your charitable gifts.

The information presented here is general in nature and is not intended to be and does not constitute financial, tax, or legal advice by the Kosciuszko Foundation, Inc. It is not advisable to make any financial, tax, or legal decisions based on the material offered here without undertaking independent due diligence and consulting your financial, tax, or legal advisor.

MONETARY DONATIONS

Donations of money are the primary and simplest way to give. Monetary donations also provide your charity with the most immediate and effective benefits. You can donate in cash, check, electronic funds transfer, credit card or payroll deduction. If you give to the KF, you can apply for an income tax charitable deduction for the full value of your gift.

To deduct any charitable donation of money it is extremely important to keep receipts as a record of your donations. If you make a cash donation of less than $250, a canceled check or a receipt from the charity showing its name, the amount, and the date of the contribution is sufficient. However, contributions of $250 or more require written acknowledgement from the charitable organization. Such acknowledgment must include the amount you gave and whether or not you received anything of value as a result of your contribution. *)

*) See section 170 of the Internal Revenue Code for details.

SECURITIES

Long-term appreciated securities

Next to gifts of cash, appreciated securities (securities that have increased in value since you bought them) are the most common assets that individuals donate to charities. This method of giving has become increasingly popular in recent years. Donating appreciated securities held for longer than one year (long-term securities), rather than selling the assets and then donating the cash proceeds, is one of the best and easiest ways for you to give more to the KF and receive substantially greater tax benefits from the donation. You can enjoy an income tax charitable deduction for the gift's full fair market value and avoid tax on the capital gains. This is probably the best known and most widely used tax benefit for charitable gifts. Another piece of good news is that the KF will never owe the capital gains tax either. It can take the stock and either sell it right away and not pay any tax, or it can hold on to it, but it will never owe capital gains tax on the appreciated value of the securities you realized.

Example:

Teresa and Jola are sisters, and each wants to make a charitable contribution to her favorite charity. Teresa wants to donate to her church, while Jola wants to give to the KF. Both sisters purchased shares in Virtual Money Corp. back in 1998 for $10,000 each. Teresa and Jola's investments now have a fair market value of $30,000 each.

In order to make her charitable contribution, Teresa sells her shares in Virtual Money Corp. Since she realizes a capital gain of $20,000 ($30,000 – $10,000), Teresa has to pay $3,000 in federal taxes on the $20,000 gain (long-term capital gains rate for most people is 15%). *) Teresa then donates the remainder ($27,000) to the church. Assuming that Teresa is in the 25% income tax bracket, she can realize an income tax charitable deduction that can save her $6,750 in taxes ($27,000 securities' full fair market value x 25%) on her charitable contribution.

Jola, on the other hand, has made arrangements with the KF to donate her shares of Virtual Money Corp. directly to the Foundation. After the transfer, Jola is not required to pay a capital gains tax on the $20,000 gain. In addition, Jola can claim an income tax charitable deduction for the full $30,000 fair market value of the stock. And, assuming that Jola is also in the 25% income tax bracket, her $30,000 charitable contribution can generate a tax savings of $7,500 ($30,000 x 25%).

Who ended up benefiting more from the above transactions? In Jola's case, the KF received a full $30,000, but Teresa's church received only $27,000. Also, Jola can save $7,500 in taxes on her contribution, whileTeresa only $3,750 in "net" taxes (a $6,750 charitable income tax deduction on the charitable contribution minus a $3,000 tax on the capital gain from the sale of the shares).

*) Tax rate on long-term capital gains depends on which ordinary federal income tax bracket you fall under: (i) 0% rate if your total income (including capital gain income) places you in the 10% or 15% tax brackets; (ii) 15% rate if your total income (including capital gain income) places you in the 25%, 28%, 33%, or 35% tax brackets, and (iii) 20% rate if your total income (including capital gain income) places you in the 39.6% tax bracket. Capital gains from assets held one year or less are taxed at the ordinary federal income tax rates in effect for the year (short-term capital gains tax).

Short-term appreciated securities

Gifts of appreciated securities held for one year or less (short-term securities) do not receive the same favorable tax treatment as gifts of long-term appreciated securities. Charitable income tax deduction is limited to the securities' cost basis (purchase price), as opposed to the full fair market value of the contributed securities. Therefore, if you hold short-term appreciated securities, there is little or no tax difference between donating the stock or selling the stock and donating the proceeds.

Depreciated securities

If you own depreciated securities (securities that have decreased in value since you bought them) , it is more advantageous to sell the securities and contribute the proceeds, rather than donate the securities. You may then claim a capital loss as well as apply for an income tax charitable deduction on your gift. You can also use the loss to offset gains you had from the sale of other capital assets during the year. In addition, if you have more losses than gains you can deduct up to $3,000 in capital losses each year from your ordinary income and carry forward any remaining balance into the next tax year.

Example:

Adam purchased stock in Bright Future Corp. for $10,000 six years ago and now his stock is worth only $3,000. He has lost $7,000 on his investment. He sells the stock and gives the $3,000 proceeds to the KF. He then deducts his $7,000 loss as a capital loss for the year (he has no other capital gains or losses for the year). He is in the 25% tax bracket, so this saves him $1,750 in income tax ($7,000 x 25%). In addition, Adam can get an income tax charitable deduction in the amount of $750 for his $3,000 contribution to the KF ($3,000 securities' full market value x 25%). Had Adam given the stock to the KF directly instead of selling it, he would have had no capital loss deduction. Instead, he would have been able to claim only an income tax charitable deduction of $750 for the $3,000 stock contribution to the KF.

If you have a stock certificate for the amount you want to donate, you can sign the back of the certificate and deliver it to the KF. If your stock certificate is for more shares than you want to donate, you can ask your broker to have the stock certificate reissued in two or more smaller certificates.

What if it's inconvenient to hand deliver the stock certificate? You can make your gift by mail. But take these precautions to protect yourself. Have your broker execute a letter of authorization describing the stock certificate and the donation you are making. Then, you can send the unsigned stock certificate to the KF in one envelope and the letter in another.

RETIREMENT ACCOUNTS

Retirement plans have proven to be a very popular way to help secure one's financial future and that of loved ones. But did you know that retirement accounts might also be an attractive and tax-favored charitable giving option?

Gifts from a retirement plan upon donor's death

Retirement accounts that grow on a tax-deferred basis (traditional IRA, 401(k), 403(b), and pension plans or other retirement plans) are often called "tax traps" for the following reasons:

1. Heirs receiving retirement account money must include such money as income on their own tax return and pay federal and state income taxes on it at their own income tax rate. Depending on the heirs' income tax bracket, mere federal income tax can consume up to 39.6% of the retirement account balance; and

2. If the taxable estate is large enough, estate taxes on the account may also be triggered. This will reduce the retirement account balance left over after taxes for the heirs even more. As of 2013, the maximum federal estate tax is 40%.

When both estate and income taxes are due, up to 63% of the retirement account could potentially be lost to taxes. This leaves only 37% for the family.*) As opposed to heirs, charities do not pay taxes and retirement plan assets can be accepted at their full value, without any tax liability.

*) You do not just add 39.6% and 40% together because the income tax is deductible from the estate taxable amount.

Example:

Steve has an estate of $7.25 million, including a $1 million in IRA. Steve's present estate plan leaves everything to his son, Robert. Under current law, $2 million of Steve's estate would be exposed to federal estate tax, and state estate tax would be due, since he lives in a state that imposes such a tax.*) Additionally, Robert will have to pay state and federal income tax on distributions from the IRA. In the end, Robert would keep less than 40% of the IRA, after taxes. $363,000 would be lost to federal and state estate taxes and $262,450 to income taxes. That would leave him with $374,550 from the original $1 million! Since Robert would get only 37¢ on the dollar, Steve revised his estate plans and left his IRA to his favorite charity, the KF, at relatively little cost to his family.

*) As of 2013 estates of $5.25 million or less are exempt from federal estate tax and sixteen states, including New York, New Jersey, Connecticut, Illinois, and the District of Columbia do impose estate taxes.

Limited/contingent gifts from retirement plans upon donor's death

You may decide that either a specific amount or percentage of your IRA goes to your heirs first, with the remainder designated to a charity. You may also make a charity the "contingent" beneficiary, receiving the funds only if yours heirs do not survive you.

Gifts from retirement plans during donor's life

When you are over 70 1⁄2, withdrawals from retirement accounts become mandatory, regardless of your need for funds. The moment you start taking funds out of your traditional IRA, 401(k), 403(b), and pension plans or other tax deferred plans you need to report such withdrawals as ordinary income and pay taxes on them. Income tax is never forgiven – it is merely delayed.

The advantage of making a charitable donation to the KF from your retirement account during your life is that you can claim an offsetting charitable income tax deduction and deduct the full amount of your contribution.

Example:

Paul is a 74 year-old retiree and his daughter, Agnieszka, lives in Poland. Ten years ago Agnieszka was a recipient of a KF scholarship in one of the major art museums in New York and since then her artistic career has taken turns for the better thanks to the professional contacts she established while in the US. Paul was very grateful for the growth opportunity the Foundation provided to his daughter and donated $150,000 from his IRA account to the KF in 2011. The KF, as a public charity received the entire $150,000 contribution completely tax-free. Paul was required to report the contribution to the KF as income on his tax return, but claimed a charitable income tax deduction for the full amount of his gift. Assuming that in 2011 Paul was in the 33% federal income tax bracket, the deduction spared him $49,500 in taxes ($150,000 x 33%).

IMPORTANT: 2013 tax-free gifts from IRA accounts

In 2013 Congress renewed a special incentive to make charitable gifts through retirement accounts.

It permits individuals to roll over limited funds from IRA accounts directly to a qualifying charity without recognizing the assets transferred as income.

You can make a completely tax-free charitable gift to the KF if:

(1) You are at least 70½ years old at the time of the gift.

(2) You transfer up to $100,000 directly from your IRA. This opportunity applies only to IRAs (traditional or Roth) and not other types of retirement plans.

(3) You transfer the funds directly to the KF. The legislation does not permit direct transfers to charitable trusts, donor advised funds, charitable gift annuities or supporting organizations.

(4) You make your gift by December 31, 2014.

Example:

Mark is planning to make a significant gift to the KF. He has been a great enthusiast of the Marcella Sembrich Voice Competition, organized by the Foundation, and would like to ensure the future of this event. Mark is 73 and has $350,000 in his traditional IRA account. He wants to take advantage of the 2014 IRA tax-free charitable gift option. He contacted his IRA administrator and completed the necessary paperwork to transfer $85,000 from his IRA directly to the KF. The administrator successfully handled the transfer. Since Mark fulfilled all the legal requirements of the tax-free transfer from his IRA to the KF, he effectively excluded $85,000 of his IRA money from his taxable income and benefited the KF with this entire amount.

Making a charitable gift from your retirement plan is simple.Just ask the administrator of the plan for a "Change of Beneficiary" form. Complete the form and return to the administrator. There is usually no charge to change of your beneficiaries.

REAL ESTATE

Contributions of real property represent one of the most complicated yet rewarding opportunities in charitable giving.

Charitable gifts of real property during donor's life

There are many great reasons for donating real property to a charity during your lifetime, beyond the satisfaction of supporting a charitable cause. You may be freed from the burden of paying real estate taxes, maintenance costs, and insurance. If you give the property to charity instead of selling it, you can avoid significant capital gains taxes on the property's appreciation, and legal and brokerage fees. In addition, when giving real property to charity during your lifetime you qualify for an income tax charitable deduction and your gift is completely removed from your taxable estate.

The specific benefits of making an outright charitable gift of real property vary depending on the length of time a property has been held by you and whether the property appreciated or depreciated in value since its acquisition.

1. Gift of appreciated real property held for more than a year

Giving appreciated real property that you acquired more than a year ago is the most beneficial option. You can receive an income tax charitable deduction for the property's full fair market value and there won't be any capital gains tax due on the property's appreciation.

Example:

Sandra is a second generation Polish-American. She wholeheartedly supports the educational mission of the KF and would like to leave a lasting contribution to the organization. She gives the KF a vacation cottage she no longer uses. It originally cost $50,000, but is now worth $150,000. By making a charitable gift of her real property to the KF Sandra qualifies for a $150,000 charitable income tax deduction, which would represent a tax savings of $42,000 in her 28% federal income tax bracket. In addition she completely avoids capital gain tax on the $100,000 of appreciation and the property will not be taxable in her estate.

2. Gift of appreciated real property held for less than a year

When you give to the KF appreciated real property that you acquired less than a year ago you may receive an income tax charitable deduction that is limited to the property's cost basis (purchase price). In addition there won't be any capital gains tax due on the property's appreciation and your gift is removed from your taxable estate.

3. Gift of real estate that has decreased in value since its acquisition

If you are contemplating a gift of real property that decreased in value it would be advisable to sell the property first in order to realize a tax-deductible capital loss, and than give the proceeds to the KF. Such a charitable contribution qualifies for the income tax charitable deduction.

Charitable gift of real property under donor's will

Giving property to the KF under a will allows you to keep control of your real estate during your lifetime. If you choose to do so, you won't qualify for an immediate income tax charitable deduction, since a will is a revocable instrument and you can change your mind as to giving away your property at any time during your life. However, the property passing under your will to the KF will be included in your taxable estate and can qualify for an offsetting estate tax charitable deduction equal to the fair market value of the property upon your death.

Retained life interest

You can opt to make an irrevocable transfer of ownership of your personal residence (or farm) *) to the KF now in exchange for the right to live in your residence for lifetime, rent it, make improvements or have another person upon your death enjoy life occupancy.

*) The term personal residence is not limited to the donor's principal residence, but includes secondary residences such as vacation homes, so long as the secondary residence does not fall into the category of rental property. The term farm is also defined broadly. It includes, for example, farm property leased to a tenant.

When you retain life interest in your real property you qualify to receive an immediate income tax charitable deduction, for the gift cannot be revoked. The amount of the deduction depends on the value of the property and your age (and the age of any other person given life interest). You can receive tax deduction benefits now, even though the KF will not take possession of the residence until after the lifetimes of the tenants you have named. There won't be any estate tax due on the property in the future, since the property is completely removed from your taxable estate.

Life income from gift of real property

You can use unencumbered real property to fund a charitable remainder trust. Once the property has been transferred to the trust, the trustee can then sell it and invest the proceeds in income-producing securities, which become the source for a lifetime income payments to you and any other recipient you name. When the trust terminates, the charity receives the remainder. See more on charitable remainder trust below.

Bargain sale

You can sell appreciated real estate held for more than a year to the KF, for less than its market value. Since the transaction is considered part sale and part charitable gift, you get some of the advantages of both. You can claim an income tax charitable deduction in the amount of the difference between the fair market value of the gift property and the bargain sale price. And you only pay a capital gains tax on the "sale" part, and not the "gift" part. *)

*) If you want to make a charitable gift of the real estate that is burdened with debt, your gift to the KF is treated as a "bargain sale" for tax purposes.

Example:

Krystyna wishes to provide the KF with funds to renovate the artwork held by the KF. With this in mind she decides to sell the house she purchased many years ago for $30,000, to the KF for the same amount, even though it was really worth $90,000 at the time of the sale. Her charitable contribution is $60,000 ($90,000 fair market value less $30,000 sale price).Krystyna qualifies for a $60,000 charitable income tax deduction on this transaction. Assuming that she is in the 28% federal income tax bracket this translates into $16,800 income tax savings ($60,000 x 28%). Furthermore, she incurs a capital gain, but the gain is much less than for a sale at full market value. She is treated as having sold 1/3 of the property, so 1/3 of the $30,000 basis, or $10,000, is allocated to the sale portion. Consequently, she has a capital gain of $20,000 ($30,000 received from the sale minus $10,000 basis attributable to the sale portion). At the end $40,000 of the property's appreciation attributable to the gift escapes taxation.

LIFE INSURANCE

The greatest advantage of a gift of life insurance is that you as the insured can make a considerably larger gift to charity by using life insurance than by giving any other assets. Relatively modest annual premiums mature into a substantial benefit at the insured's death and the policy proceeds are paid regardless of how many premiums have been paid. In addition, life insurance can be a convenient vehicle for charitable giving simply because you may find that the original reason for purchasing a life insurance policy is no longer relevant. For example, in the past you purchased a life insurance policy because you wanted to make financial provisions for your children in the event of your premature death, but when the children are grown and self-supporting you decide to make your favorite charity the beneficiary of your life insurance policy.

You can give your life insurance to the charity in three different ways and potentially benefit from either an income tax or estate charitable deduction:

1. When you name the KF as the beneficiary of your life insurance policy and assign it ownership of the policy you can benefit in the year you transfer the policy ownership by claiming an income tax charitable deduction for the lesser of premiums paid or the policy's fair market value.

2. When you name the KF the beneficiary and assign it ownership of the policy, and continue to pay the premiums to maintain the policy, premium payments are considered charitable contributions and you are eligible for an income tax charitable tax deduction (in the full amount of your payment) in each year you pay the premium.

3. When you name the KF as beneficiary of your policy, you retain lifetime control over the policy. You can borrow against the policy, take cash withdrawals, and even surrender the policy outright. Furthermore, you have the right to change the beneficiary and reassign the policy at anytime, should there be a change of heart about the charitable gift. Since you keep lifetime control over the policy, the KF may not recognize the gift until after you die. As a result you are not eligible for an income tax charitable deduction, but upon your death your estate will be eligible to an offsetting estate tax charitable deduction.

"Replacing" assets given away to charity for the family

In recent years, probably the greatest increase in using life insurance in charitable plans has been to replace for heirs of an estate the value being given to a charity. A significant outright charitable gift might reduce the value of inheritance for family members. Your tax savings resulting from the charitable income tax deduction may even be enough to cover the insurance policy premium. The life insurance proceeds are not included in your estate and your heirs can receive it tax-free.

Example:

Ewa, a business owner in Brooklyn with a deep appreciation for the KF's work, makes a charitable gift of a building that has appreciated in value since she acquired it long ago to the KF. She knows that this allows her estate in the future to realize greater tax savings than if she had left the building under her will to her children. She might also have sold the building, but then she would have been forced to pay capital gains tax on the building's appreciation.

After making the donation to the KF she purchases life insurance for the benefit of her children, an expense that she would have paid anyway in taxes, had it not been for the charitable deduction she received for her gift to charity. Instead of receiving a building, her children will receive cash from the insurance policy - and all of this happens outside the probate process.

Your life insurance policy can be also used to potentially "replace" the retirement account's value. If you do not need to rely on IRA income during retirement, you can take taxable withdrawals from the account to help pay for policy premiums.

Example:

Jack, 72 an active member of the Polish-American community in New York, is contemplating a gift to the KF. He is recognizing the importance of supporting the Foundation, especially during trying economic times. He wants to use his resources prudently, thus he seeks professional advice.

Let's imagine that Jack has a $1 million balance on an IRA account at his death and his heirs are in the 35% federal income tax bracket. Upon Jack's death his heirs would have to pay $350,000 in income taxes on his IRA account. Because of the size of Jack's estate there would not be any federal estate tax due and only a handful of states would impose state estate tax.

In order to avoid a tax burden to Jack's heirs and at the same time to fulfill his wish to support the KF, Jack has been advised to: (1) name the KF as the IRA beneficiary (this way Jack could provide the Foundation with $1 million IRA funds entirely tax-free); and (2) replace the $1 million IRA balance for his family with the proceeds from a life insurance policy by taking taxable mandatory withdrawals from his IRA to help pay life insurance premiums. Jack gladly accepted the suggestion and is happy to accomplish giving to both his family and the KF.

CHARITABLE TRUSTS

Charitable trusts are presently among most popular instruments of charitable giving. According to IRS in 2011 charitable entities received over $3 billion from charitable trusts. Before you set up a charitable trust you need to do some serious thinking. Charitable trusts as irrevocable instruments require that you give up legal control of your property. Once the trust becomes operational, you cannot change your mind and regain legal control of the trust property.

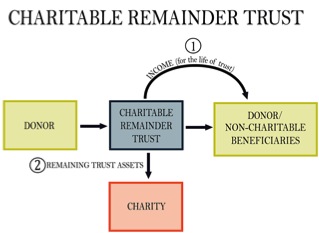

A. CHARITABLE REMAINDER TRUST

A charitable remainder trust is a formal trust arrangement in which you, as the donor set up and fund a trust that will pay an income stream to you and/or another designated person (non-charitable beneficiary) for life or a term not to exceed 20 years. The assets of the trust are invested and managed by a trustee. Upon completion of the term of the trust, the remaining trust assets pass to the charity.

There are two kinds of charitable remainder trusts depending on the way a donor structures the payments he will receive under the trust:(1) annuity trust - pays each year, the same dollar amount you choose at the start. Your payments stay the same, regardless of fluctuations in trust investments. Theoretically, you can make the payments as high as you want. Practically, however, there are limits. First of all, the higher the payments, the lower will be your income tax charitable deduction. On top of it, high payments might eat into principal, possibly even using it all up before the payment term is over and leaving nothing for the charity; and (2) unitrust - pays each year, a variable amount based on a fixed percentage of the fair market value of the trust assets. The amount of your payments is determined each year. If the value of the trust increases, so do your payments. If the value decreases, however, so will your payments. Under IRS rules, you must receive at least 5% of the value of the trust each year.

A charitable remainder trust is a pretty flexible instrument and is always tailored to your specific needs. You determine the length of the trust and the payout rate. It can be set up to supplement retirement funds, provide educational funds for children or grandchildren, or provide support for someone you care about. Charitable remainder trust can be also an effective strategy for planning for your future retirement as the trust can provide that income distributions do not commence immediately. For example, the trustee can sell the appreciated assets, reinvest the proceeds, defer payment of tax and delay distribution (and income recognition) to you as the donor until you reach age 65 and are in a lower tax bracket.

Appreciated assets, cash, unencumbered real estate, and retirement accounts of at least $100,000 are recommended assets to consider for creating a charitable remainder trust. It can be created during your life or through your will.

Charitable remainder trust created during donor's life

When you create a charitable remainder trust during your life you can receive an immediate income tax charitable deduction for the value of your gift. The value of the gift is not simply the value of the property. The IRS deducts from that value the amount of income you are likely to receive from the property. For example, if you donate property with a value of $100,000, but can expect to get $25,000 in income back, the value of your gift is $75,000. In addition, there will not be any capital gains tax due on the property's appreciation. Furthermore, when the trust property eventually passes to a charity (at your death or at the end of the term of years specified in the trust), it is no longer in your estate - so it is not subject to estate tax. And finally, charitable remainder trust can turn non-income producing assets into income-producing assets and as a result provides you with an increase in income.

Example 1:

Clara, a 70-year-old retired piano teacher, was a recipient of the 1st award at the Chopin Piano Competition at the KF thirty-five years ago. Since then she has been following the competition with great interest. She would like to make sure that the Competition would continue for years to come and with this in mind she decides to make a gift to the KF. Clara owns a condominium worth $300,000. She paid $20,000 for it thirty years ago. Initially she used it as a vacation home, but as she has gotten older and her family moved away from the area, it gradually became an investment property, bringing her about $18,000 per year.At 70 she wishes to avoid haggling with tenants and making repairs to the condo. Based on professional advice she creates a charitable remainder trust, naming the KF as the charitable beneficiary, and funds the trust with her condo. The trustee of the trust sells the condo for $300,000 and invests the money in a mutual fund. Clara will receive income from the $300,000 for life. Assuming that under the trust Clara sets the annual payment rate at 6%, she will get $18,000 in her first year. *)Clara also qualifies to receive an immediate income tax charitable deduction of nearly $140,000 that can save her in federal income taxes $35,000 in her 25% tax bracket. Furthermore, she is free from capital gains tax on her $280,000 profit. She is satisfied knowing that the trust will mean a wonderful thing for the KF and that she has substantial tax benefits, similar income, and fewer worries without the property.

*) The trust would be revalued every year, and the amount of the annual payment will depend on the trust assets' fluctuation.

Example 2:

Maria and Piotr, both 65, are ready to retire and move to Florida. They have stock purchased nineteen years ago with a fair market value of $800,000, a cost basis of $250,000, and annual dividends of $22,000. This stock represents 70% of their portfolio, and they are concerned about a lack of diversification. In addition, Maria and Piotr would like to leave a gift to the KF, their favorite charity. After consulting an attorney the couple decided to donate their entire stock to a charitable remainder trust benefiting the KF and elected to receive 5.5% income from the trust assets annually for life. Subsequently, the trustee sells the stock and purchases a diversified portfolio of assets. Maria and Piotr will receive an income of $44,000 in their first year. They can also receive an income tax charitable deduction of about $243,000 in the year of the gift, with tax savings of little over $85,000 in their 35% federal income tax bracket. Finally, they avoid the capital gains tax of $82,500 on the $550,000 (the appreciated value of the property: $800,000 - $250,000), and double their income from the diversified portfolio.

Example 3:

Jadwiga 68 is a retired physician of Polish decent. Many years ago thanks to the KF's grant she was able to spend a summer in Poland studying Polish language and culture. Jadwiga decided to create a charitable remainder trust that will eventually provide for the similar opportunities to other Polish Americans. She funds the trust with $200,000 of appreciated securities she has purchased many years ago for $58,000, and currently bringing only about 3%. She sets up the trust to pay her 6% annually for her life. She knows that if she sells her stock and purchases a better performing one instead the capital gains tax on the appreciation will consume 15% of the proceeds, leaving less to reinvest. At the end of the trust term Jadwiga's gift will pass to the KF to create a fund in her name for the purpose of educating Polish Americans in Poland. By establishing the trust she: (1) doubled the income from her assets; (2) avoided the capital gains tax that would be due if she had sold the stock in order to reinvest it; (3) generated a substantial charitable income tax deduction of over $86,000; and (4) helped to preserve beautiful initiative of the KF.

Charitable remainder trust created under donor's will

When a charitable remainder trust is created under your will, your estate can claim an estate tax charitable deduction for the present value of the remainder interest. In general a charitable remainder trust under donor's will is less common than such a trust created during the donor' life. The reason is that there are less financial benefits to it.

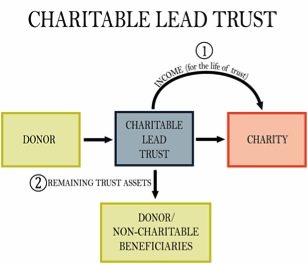

B. CHARITABLE LEAD TRUST

A charitable lead trust is a formal trust arrangement in which you as a donor set up and fund a trust that will pay an income stream to the charity for a specified number of years (for the life of the trust). The assets of the trust are invested and managed by a trustee. At the end of the trust term, the remaining trust's assets return to you (grantor lead trust), or more frequently are transferred to one or more non-charitable beneficiaries designated by you (non-grantor lead trust). It is called a lead trust because the charity is entitled to the lead (or first) interest in the trust asset, and you or non-charitable beneficiary receives the remainder (or second-in-line) interest.

You may establish a charitable lead trust either during your lifetime or under your will, but it's most common to do it under will.

A charitable lead trust is a complicated but powerful instrument for donors who anticipate high estate and gift taxes in transferring their wealth to heirs. For those donors, a charitable lead trust may be one of the most potent tools to make a significant reduction in estate and gift taxes while also locking in a large, presently accessible gift to charity.

Three factors will affect your potential tax deduction: the duration of the trust, the amount it pays to the charity each year, and the Applicable Federal Rate (AFR) *) in effect when you establish the trust. Lengthening the trust term and enlarging the payments to the charity will increase your tax benefits.

*) Applicable federal rate for determining among others, the present value of an annuity, an interest for life or a term of years, or a remainder interest.AFR for November 2013 is 2.0%.

Considering the extreme complexity of a charitable lead trust, you need the assistance of an experienced professional in order to execute an effective charitable lead trust instrument.

1. Non-grantor lead trust

Charitable lead trust created during donor's life

When you create a charitable lead trust during your life and designate your children as non-charitable beneficiaries, they receive the remainder interest at the end of the trust's term. You as a donor do not qualify for a charitable income tax deduction. However, you can receive a charitable gift tax deduction. You report the gift to your children in the year the trust is set up. The taxable gift is calculated by subtracting the present value of the income stream to the charity*) from the initial funding trust amount, and in the end it means great tax savings for you.

*) Present value is based on a complex formula and there is no need to go into details here.

Example:

William sets up a charitable lead trust in April 2005 when the Applicable Federal Rate (AFR) is 5%. He funds the trust with $1 million in assets and specifies that: (1) the KF receives $70,000 in annual payment for a period of 15 years and (2) after the trust terminates, the remainder interest goes to his two children. The present value of the income stream to the KF is valued at $845,821, and as a result William has only a $154,179 taxable gift to his children ($1 million minus $845,821)!

A lower AFR increases the gift tax charitable deduction. With today's low rates it is a good time to establish a charitable lead trust now, so you can obtain a significant tax savings. It is even possible to structure the trust so that there is no gift tax related to the remainder interest ultimately passing to heirs!

Example:

Adam contributes $1 million in March 2008 to a charitable lead trust paying $70,000 a year to the KF for 21 years, the remainder interest passing to his children. Adam reports a gift to his children in the year the trust is set up of zero tax liability! Adam needed $1 million at the time the trust was created, earning 3.6% a year for the next 21 years, to produce an income stream of $70,000 a year for 21 years. The present value of the income stream to the KF is exactly $1million. We subtract $1 million (present value of income stream to the KF) from $1 million (initial trust funding amount) to determine the tax reportable gift of $0 to his children!

Charitable lead trust created under donor's will

When the remainder interest under the trust passes to designated non-charitable beneficiaries after your death, such a transfer will be subject to an estate tax, but only the present value of the remainder interest will be taxed. Any appreciation in the trust assets' value will be entirely estate tax free. It is possible again to structure the trust so that there is no estate tax related to the remainder interest ultimately passing to heirs.

Example:

When Robert created the charitable lead trust under his will his property was worth $1 million. $700,000 of that amount, as the present value of the income stream to the KF, was tax-deductible gift to the KF, and the property's value has increased to $3 million by the time the trust ended. Robert's heirs received $3 million, but there was estate tax on a mere $300,000 ($1 million minus $700,000).

If you want to pass your business under your will to the next generation, but you are worried about estate tax forcing a sale or liquidation, a charitable lead trust could hold closely held stock for a certain period paying income to the charity, and then your children would succeed to full ownership. Estate tax would be considerably reduced, lessening the burden on the company.

Please note that appreciating assets such as stocks, real estate (especially income producing real estate held in a limited partnership with no mortgage), and cash, are the best for funding a charitable lead trust. Such assets pass to one's heirs with the appreciation, and the gain will not be subject to gift or estate taxes.

For the trust to qualify for tax benefits, the payments must be either a fixed dollar amount (charitable lead annuity trust) or a fixed percentage of the trust assets as determined annually (charitable lead unitrust). A trust that simply pays net income to charity, whatever it may be won't be enough.

Choosing a method of determining the charitable payout depends on what you are trying to accomplish and what type of assets you hold. If you believe that your property will appreciate in value and would like your heirs to benefit from the growth, then a charitable lead annuity trust is preferable.

Example:

Carl contributes $1 million to support the KF with growth stock with a total net return of 10% a year. The stock funds a 15-year lead annuity trust that pays $80,000 per year to the KF. When the trust terminates, the principal will have grown to slightly more than $1.6 million.

If Carl had transferred the stock to a charitable lead unitrust instead, the principal distributed to his heirs would have been approximately $1.3 million (a reduction of about $300,000); and since the KF receives a percentage of trust assets as valued each year, the charity would share in the growth.

2. Grantor lead trust

Almost no one uses the grantor lead trust because there is very little benefit to it. In a grantor lead trust, the donor receives the remainder interest at the end of the trust's term. As the interest owner the donor is taxed on all the income. Even though the donor is entitled to claim a current income tax charitable deduction for the present value of the income payments to charity he is responsible for paying the taxes on all investment income and realized capital gains of the assets in the trust.

More on donor's income tax charitable deduction

The Internal Revenue Code section 170 allows an income tax deduction for charitable contributions, which gives charitably inclined taxpayers the ability to reduce their tax liability. You can take advantage of a charitable income tax deduction if you itemized your deduction on your tax return. Your deduction for charitable contribution to the KF cannot be more than 50% of your adjusted gross income (AGI). The 50% limit applies to the total of all charitable contributions you make during the year. A special 30% limit applies to contributions of "capital gain property". Capital gain property are assets that would have recognized gain if sold at the fair market value on the date of the contribution and are held for more than one year, for example: long-term appreciated securities, real estate, jewelry, coin or stamp collection, furniture.

You can carry over any contributions you cannot deduct in the current year because they exceed your AGI limits. You may be able to deduct the excess in each of the next five years until it is used up.

When you contribute appreciated assets you might find the 30% limitation too restrictive and wish that the higher 50% limitation be applied to your gift. For example, the donated asset may be only slightly appreciated. Or the donation may be quite large relative to the your income, with the result that a large portion of the gift will have to be carried over into years when the donor will not be able to make such good use of deductions. Under these circumstances you may use a special election. You can elect to use the cost basis (assets' purchase price) for a charitable deduction and than your AGI limitation increases to 50%. However, 50% applies to all gifts made during a year or carried over to that year.

If you claim a deduction for a contribution of property (other than cash or publicly traded securities) worth more than $5,000, obtain a qualified appraisal. A written appraisal is not required for contributions of non-publicly traded stock with a value of $10,000 or less.

More on donor's gift and estate taxes and estate/gift tax charitable deduction

The federal gift tax is assessed on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies to the transfer of any property, including cash, jewelry and real estate, and may also be incurred if you add someone to your bank or investment account or to the deed for your real estate. The one who gives property to another is responsible for paying the gift tax.

Many ordinary gifts are not taxable: (1) gifts that are not more than the annual exclusion amount; (2) tuition, if you pay it directly to the school; (3) medical expenses you pay directly; (4) gifts to your spouse (if your spouse is a U.S. citizen); (5) gifts to a political organization for its use; and (6) gifts to certain charities.

The annual gift tax exclusion is the amount that can be given away by an individual in any given year to an unlimited number of people free from any federal gift tax consequences at all. For 2013 the annual gift tax exclusion is $14,000. If spouse is not a U.S. citizen, there is an annual exclusion of $143,000 in 2014.

It is important to distinguish the annual gift tax exclusion from the lifetime gift tax exemption. The lifetime gift tax exemption is the total amount that can be given away by an individual over his/her entire lifetime to any number of people that will be free from gift taxes. The lifetime gift tax exemption is tied directly to the federal estate tax exemption so that if you gift away any amount of your lifetime gift tax exemption, then this amount will be subtracted from your estate tax exemption when you die. In short the federal gift tax is part of what is called the "unified" federal gift and estate tax. The idea is that whether you give assets away while you are alive, or leave them at your death, they are taxed the same way, at the same rate. If there were no gift tax, then anyone could completely avoid the estate tax by giving everything away just before death.

For 2013, the lifetime gift and estate tax exemption is $5.25 million. Each of us can give away during life or leave under will up to $5.25 million without owing federal gift and estate tax. For example, if an individual gives away $3 million during his/her lifetime and then dies in December 2013, the individual's federal estate tax exemption will only be $2.25 million.

Because of the $5.25 million gift and estate tax exemption gift tax is rarely paid during the donor lifetime. Even though you need to file a gift tax return if you make a taxable gift, you can choose to either pay the tax or use some of your unified gift and estate tax exemption to defer and probably avoid paying it at all. Usually, tax is not paid until you make so many taxable gifts that the $5.25 million exemption is exceeded.

Presently, only two states, Connecticut and Minnesota, impose their own gift taxes. Connecticut gift tax is owed when the value of all taxable gifts made by a resident since 2005 (not counting out-of-state real estate) reaches $2 million. Minnesota has a $1 million gift tax exemption.

The federal estate tax is imposed upon the right to transfer a person's assets to his or her heirs after death and is assessed on the net value of a deceased's estate before distribution to the heirs.

As it was already mentioned before, the federal estate tax exemption amount for estates of people who die in 2013 is $5.25 million. Transfers from one spouse to the other are generally estate tax free. One popular feature of the current estate tax law is that spouses can combine their estate tax exemptions, effectively letting married couples leave $10.5 million without owing any estate tax.

The top federal gift/estate tax rate is now 40%. The 40% rate kicks in at a taxable gift/estate of just $1 million, far below the $5.25 million exemption available against gift/estate tax. This means that any donor who needs to pay gif/estate tax will pay it at the 40% rate.

Gift and estate tax charitable deduction

Under section 2055 of Internal Revenue Code transfers upon death to qualifying charity, like the KF, are eligible for an unlimited estate tax deduction. Every dollar donated to the KF can be deducted from your estate tax. If you donate $1 million, then $1 million can be deducted from your estate tax. However, donating more than the amount of estate taxes owed does not earn you any tax benefit. If your estate owes $2 million in taxes and you donate $3 million, the extra $1 million in donation has no tax benefit. Additionally, there's no limit to how much you can deduct. It means that the estate deduction is not subject to the percentage limitations that apply with respect to the charitable income tax deduction.

There are two ways to reduce estate taxes using charitable tax deductions: (1) the charitable donations can lower the total value of the estate below the current exemption level ($5.25 million), which cancels out the estate tax altogether; or (2) if charitable giving will not reduce the estate's value below the exemption level, donations can reduce estate taxes by $1 for every dollar donated. Up to the total amount of tax owed.

A charitable gift to the KF during the donor's life can generate a gift tax charitable deduction under section 2522 of Internal Revenue Code. A donor is allowed an unlimited charitable gift tax deduction for lifetime gifts to the KF and such deduction is not subject to the percentage limitations that apply with respect to the charitable income tax deduction.

Generous giving!